If you’re curious about the world of cryptocurrency, you’ve likely heard of Ethereum. It’s a name that surfaces time and again, right alongside Bitcoin. But what is Ethereum, exactly and is Ethereum worth investing in? We need to first look at the history of this cryptocurrency and understand its functions. In simple terms, Ethereum is a decentralized platform that uses blockchain technology to run smart contracts. These contracts are applications that run exactly as programmed without any possibility of fraud or third-party interference.

When I say Ethereum is the evolution of blockchain, I mean it quite literally. While Bitcoin introduced us to decentralized digital currency, Ethereum took it a step further by implementing a platform where developers can build and deploy their own decentralized applications (DApps). This was all part of the vision of a young programmer named Vitalik Buterin. Buterin, along with a team of other co-founders, brought Ethereum to life in 2015 with the idea that blockchain could do more than just record monetary transactions.

The technological leap from just a digital currency to a wider blockchain application platform is what sets Ethereum apart. Smart contracts are the backbone of this leap—a concept that automates and enforces contracts digitally, revolutionizing how we think about agreements in the digital space. This innovation expanded the potential of blockchain technology beyond just a payment method and gave rise to a new ecosystem of decentralized services and applications.

The Chronological Growth of Ethereum: Its Path Since Inception

Ethereum has been a game-changer in the blockchain world since its inception. I’m going to rewind back to 2015, which marks the birth year of Ethereum. Unlike the early days of Bitcoin, which was met with wide skepticism, Ethereum gained rapid interest for its innovative capabilities – especially smart contracts, which expanded blockchain utility beyond mere transactions.

As we look through the intervals of Ethereum’s timeline, you’re going to find out about its volatile journey. From its initial coin offering (ICO) to the infamous DAO hack in 2016, I want to make it clear how these events shaped its resilience. The introduction of Ethereum Improvement Proposals (EIPs), like EIP-1559, has been pivotal in addressing scalability and transaction fee issues.

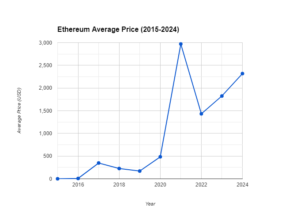

If you’re curious about Ethereum’s growth trends, pay attention to its market presence. Starting off as an ambitious project, Ether, its native cryptocurrency, has witnessed waves of bullish and bearish cycles. The decentralized finance (DeFi) boom of 2020 catapulted Ethereum to new heights as it became the backbone for a plethora of projects.

Now, talking about network upgrades and forks, Ethereum doesn’t shy away from change. We’ve seen several hard forks, like Byzantium, Constantinople, and more recently, London, each introducing key improvements. These are not mere updates; they are transformative steps towards a more efficient and sustainable network – an ongoing journey with the much-anticipated transition to Ethereum 2.0 around the corner.

In my opinion, understanding Ethereum’s past is crucial to grasping its potential. Its history isn’t just about the evolution of technology, but also the community and the ecosystem that’s grown with it. This sets the stage for what comes next – Ethereum’s use cases, which have exploded far beyond the initial vision of digital money.

Exploring the Versatile Use Cases of Ethereum: More Than Just Currency

Ethereum’s technology stretches far beyond just being a cryptocurrency. It introduced smart contracts to the world, self-executing contracts with the terms directly written into code. These smart contracts power what we call decentralized applications, or DApps, which are transforming various industries.

The finance sector is perhaps the most talked-about when it comes to Ethereum’s use cases. Known as Decentralized Finance, or DeFi for short, Ethereum enables peer-to-peer lending, borrowing, and the creation of stablecoins without traditional financial intermediaries. Essentially, it’s reshaping how we interact with money in a digital world.

In the realm of healthcare, Ethereum offers secure and immutable ways to store patient data with patient consent. It’s not just about security; it’s also about interoperability. Different healthcare providers can access this data, streamlining the process and making it more efficient.

Ethereum has even made waves in the world of art and collectibles through non-fungible tokens (NFTs). Artists and creators use NFTs to assert ownership over their unique digital creations, enabling them to sell and monetize their work in ways not possible before.

The proliferation of decentralized autonomous organizations (DAOs) is another exciting use case. A DAO is an organization represented by rules encoded as a computer program that is transparent, controlled by organization members and not influenced by a central government. Ethereum’s smart contracts facilitate DAOs, allowing like-minded individuals across the globe to collaborate on projects or investments without a central authority.

These applications illustrate that Ethereum’s potential goes beyond just being a currency; they pave the way for a decentralized and automated future. If this is the wave of the future, the next logical question is: ‘Is Ethereum still worth investing in today?’ Well, looking at these innovative use cases, Ethereum is clearly at the forefront of the blockchain revolution, potentially making it a significant investment consideration.

Assessing Ethereum’s Worth as an Investment Today

I’m going to break down Ethereum’s current status in the ever-evolving cryptocurrency market. You’re going to find out about the intricate balance of risk and reward, especially as it relates to Ethereum.

In my opinion, evaluating Ethereum requires a multi-faceted approach. It’s not just a digital currency; it’s a platform for building decentralized applications. This dual nature impacts its investment potential.

Now, let’s look at recent market trends. Ethereum’s fluctuating price can be influenced by anything from global economic conditions to shifts in blockchain technology.

You can always adjust your approach down the road, but for now, choose to consider not only the historical performance but also how adaptable Ethereum’s underlying technology is.

Don’t worry too much about day-to-day volatility. Instead, focus on long-term trends and Ethereum’s ability to adapt to regulatory changes, technological advancements, and shifts in user adoption.

Comparing Ethereum to other investment vehicles may feel like comparing apples to oranges. Traditional assets like stocks and real estate tick differently than cryptocurrencies. What’s more, within the crypto ecosystem, each coin has its own mechanics.

In summary, Ethereum’s investment case isn’t cut and dry. It involves scrutiny of many variables – from technology and governance to market sentiment and global economics. Making an informed decision takes work, but I’m here to help you with that. Next, we’ll gaze into the crystal ball of Ethereum’s future, so stay tuned.

My Experience with Ethereum

Like Bitcoin, I missed out on its early days and therefore, did not get to experience its growth in value over the years. As mentioned earlier, Ethereum came about in 2015. I did not get into cryptocurrency until 2017 and even then, I didn’t understand quite a bit of the ins and outs of crypto and their use cases. If had I done more research, I more than likely would’ve started investing in Ethereum at the time.

Now I do have some tokens in what is called Ethereum Classic which was a hard fork of the original Ethereum and I will go over more of that in a future post. Ethereum is the second most valuable cryptocurrency behind Bitcoin. With that being said, it is way behind Bitcoin’s worth. Today, the value of Bitcoin is a little over $60,000 a coin while Ethereum is hovering a little over the $3,000 mark.

I have bought a little bit of Ethereum before, but I’ve only held it for a short period of time as I’ve used it to purchase other crypto. A lot of projects and new cryptocurrency are based on the Ethereum blockchain and so it makes using Ethereum a lot easier. A lot of new cryptocurrency companies will launch what’s called a limited time presale of its crypto to people and the only type of payment they’ll accept for it is typically through Bitcoin and Ethereum. What I’ve done in this case is buy a little bit of Ethereum off of an exchange and then send it to the address of the presale site and then I purchase the amount of the new crypto that I want.

I’m going to give a little bit of a warning of what I just mentioned and will explain more in detail in a future post. It is VERY IMPORTANT that you do major research into the company that is launching a new cryptocurrency because some of them are not legitimate and sadly, one of them I fell for and lost the Ethereum I sent to that site. Fortunately, it wasn’t a lot so it didn’t hurt me financially, but I know there are others who sent a lot and therefore lost a lot of money. The sad reality is that there are a lot of cryptocurrency scams out there and I promise that I will talk quite a bit about those and how you can protect yourself and others from them. Regardless of what happened in that instance, I still plan on investing a little bit into Ethereum here and there for the long term.

Ethereum’s Future: Expert Projections and Ongoing Developments

Now you’ve got a handle on what Ethereum is, its evolution, and its vibrant ecosystem. But what comes next is crucial for understanding its potential future value. Ethereum is on the verge of a significant transformation with Ethereum 2.0, which aims to enhance the platform’s scalability, security, and sustainability. This shift to proof-of-stake consensus represents a monumental leap towards a more eco-friendly blockchain.

The implications of such an upgrade are profound. It’s not just about curbing energy consumption – it’s about aligning Ethereum with contemporary concerns about sustainability, which could, in turn, incentivize a broader base of investors and users. Moreover, with faster transaction speeds and reduced fees, Ethereum 2.0 seeks to address two of the most common critiques it faces.

Experts diverge in their projections for Ethereum’s future, but the consensus leans towards positivity. The versatility of its platform and innovative strides suggest a bullish outlook. Vitalik Buterin and other core developers remain committed to Ethereum’s progression, which is a strong indicator that Ethereum will continue to be a significant player in the blockchain space.

Nonetheless, in the fluctuating realm of cryptocurrencies, nothing is set in stone. Staying informed and vigilant is paramount if you’re considering Ethereum as a long-term investment. The journey of Ethereum is an unfolding story, one that promises advancements, challenges, and, for the savvy investor, opportunities.

Finally, I encourage you to continue researching and monitoring Ethereum’s progress. Be proactive in seeking knowledge from a variety of expert sources and never underestimate the value of understanding the technical developments and market trends. Whether Ethereum is a golden opportunity or a measured risk, the choice is yours – but it’s a decision that should be made with both eyes wide open.